If you have not done so, you can read the first part of this series in Part 1: Learning about startups with JETRO in Cairo and Istanbul

Heading to Istanbul

After three days of intense meetings and learning about the MENA region startups and tech scene, we headed to Istanbul. Not all of the Japanese delegation from Cairo joined for the second leg of the trip, but we met up with many Japanese delegates who were based in Istanbul itself.

Briefings at JETRO Istanbul

After landing in Istanbul, we went straight for briefings at the JETRO office in Istanbul.

Serkan Ünsal of startups.watch

Serkan is the editor and co-founder of startups.watch and an expert in the tech and funding ecosystem for Turkey.

Serkan explained to us the current trend of startups in Turkey. In 2011 to 2015, most of the startups were working in the e-commerce or marketplace sectors, but for the last five years more and more are working on products for the fintech, gaming and AI sectors.

B2B is much more prominent than B2C, and the main cause is the issues within the local economy of Turkey. Turkey has a huge youth population, but 25% of that population are unemployed, which means it's difficult to monetize on B2C solutions as people will not want to pay for them.

The ever-changing political landscape is also another hurdle for businesses in Turkey generally, and makes it especially difficult in the context of getting funds established in Turkey.

Serkan also mentions that there seems to be concentration of different sector in different cities, for example you can find much more engineers and people working in deep tech in Ankara, while in Istanbul there will be more people working on e-commerce and social games.

Numan Numan of 212

Numan, who is the managing director of 212 who has experienced in working in Tokyo and New York in the banking sector specializing in startups, returned to Istanbul to help build the startups and the tech ecosystem here.

The discussion with Numan was interesting. He was critical on the stability of the political scene in Turkey, and flatly mentions that there is little hope and interest for startups that service the Turkey market, or exiting in Turkey via IPO or even an M&A.

According to Numan, successful startups in Turkey are those who target markets outside of Turkey, and currently, the startups that he funds are targeting the US or Asia markets. These are many realistic strategies and can attract potential M&A buyers or even for an IPO in the US or London.

On the flipside, Numan says that the instability of things in Turkey has made the people here very adaptive to change and move fast, which is a positive trait for entrepreneurs.

Networking dinner

After the intense briefing and discussions at JETRO HQ, we all went to a nearby local restaurant for a networking dinner which was around 10 minutes away by foot.

During the dinner, we managed to talk to companies funded by Numan's 212 funds, and one of them was MallIQ. MallIQ is a "location intelligence platform" that basically allows you to target consumers in a more precise way, even if they are indoors which traditionally are difficult to do due to restrictions like unavailability of GPS.

The other company we talked to was Ommasign, a company with the vision of changing all signboards in the world. They allow you to customize your digital signage in any way that you'd like, even making them interactive.

Under Numan's 212, MallIQ and Ommasign complement each other with their different technologies. It would be really interesting to see them coupled with a local marketing initiative that also helps companies collect customer data for targeted marketing campaigns.

Incubation and technology parks

In our second day in Istanbul, we visited co-working spaces and technology parks to see for ourselves where and how the tech startups work.

Kolektif House

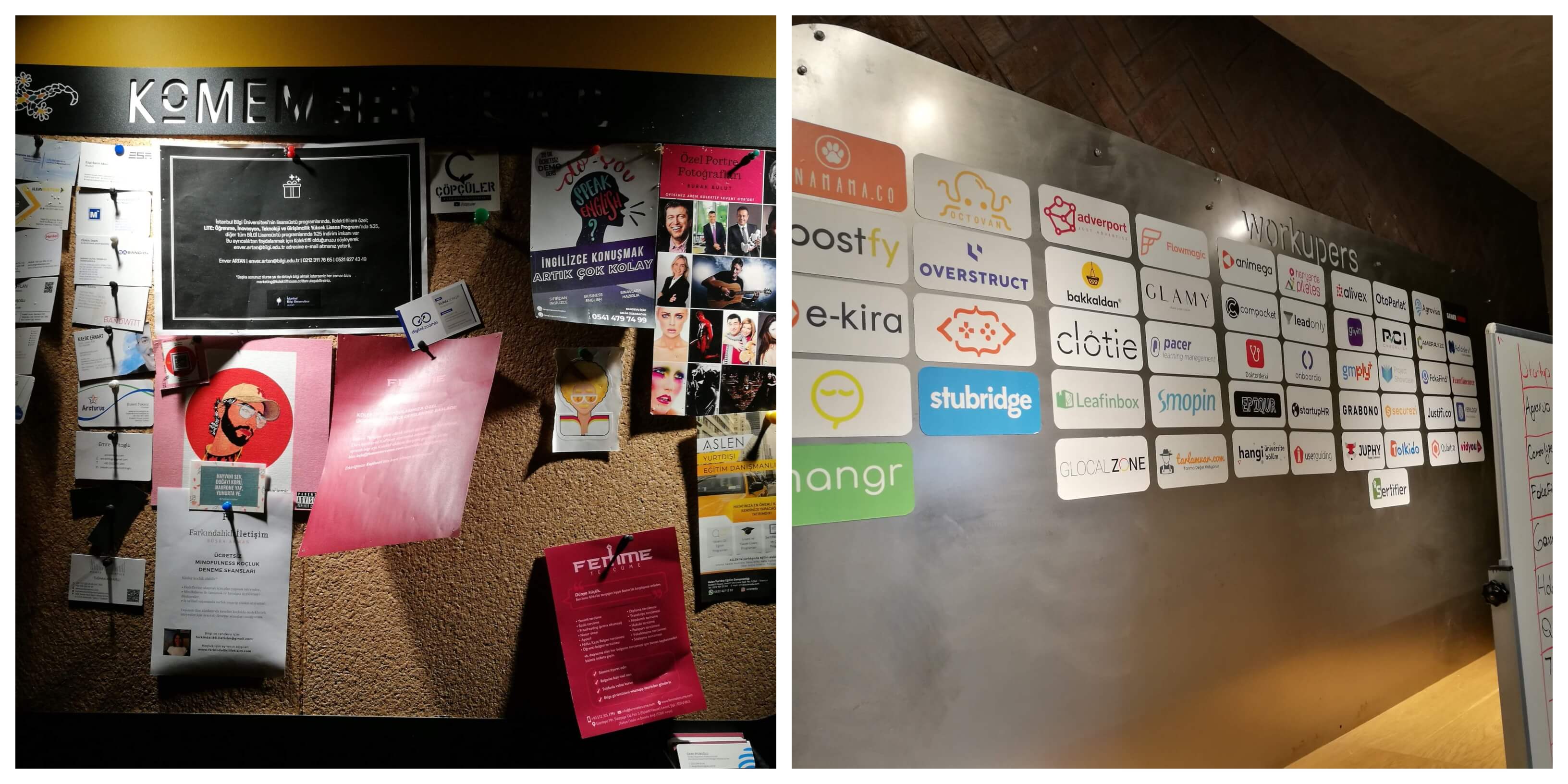

The first visit that we made was to a co-working space and incubator called Kolektif House in Levent.

It's a very chic co-working space, and they currently have four locations around Istanbul.

Kolektif House describes themselves as something like a profitable WeWork. They currently have around 3000 members, where large portions are SMEs and freelancers, with having 11 VCs as part of their tenants. The occupancy rate is 95% in all of their locations.

Prices for their space is TRY400 (around USD70) for a virtual office (just an address), TRY1000 (around USD170) for nomads without a private space, TRY1300 (around USD220) for a fixed desk and TRY2500 (around USD420) for a starter room that can fit 2 people.

They also have an incubator program that is backed by İş Bank Maxis. Kolektif House themselves doesn't do investments, but provide the office space and facilities to the startup teams.

A typical investment is around seed to pre-A at around USD 150K to USD 1M.

We also received pitches from some of the startups that were working in Kolektif House. One of them was bandwitt which is aiming to disrupt the consultancy industry. They have a model that is similar to Grab or Uber but for consultants.

One other pitch I found interesting was from vidyou. vidyou allows you to create videos quickly and easily through their API. Their premise is that more and more of us are consuming videos than other types of media, and the key is to allow all of us to create more videos as easily as possible.

Yildiz Technology Park

After Kolektif House, we went to visit one of the technology parks in Istanbul. Technology parks are one of the mainstays of the Turkish tech scene, where many companies with new technologies gather to build their products.

The Yildiz technopark is 100% occupied and there is a waiting list to get in. There are many merits for companies to get accepted to technoparks in Turkey: Tax exemptions, VAT exemptions, wage tax exemptions for employees doing RnD and many more perks. Most of the companies in the tech parks are hardware-based product companies.

On of the impressing pitches we had during our visit was from solarcurtain a startup that is producing curtains that can generate power from solar, so instead of having flat and hard solar panels on top of your roofs, you hang them as curtains to your windows to capture sunlight. They boast a 22% efficiency rate, and the pricing is USD250 per meter square for their curtains. Watch their video here

Istanbul Technical University

Our last visit for the day was to the ITU College, which in itself is located in a technopark.

We brought around the campus and visited labs where they were building hardware products. When we were there, we met with a team modifying a generic drone that they've bought over the shelf.

They also have their own co-working space within the campus to host the startups in their incubation program, and also work with foreign accelerators.

Ending our Istanbul trip

After talking with people on the ground working directly in the technology sector of Turkey, and seeing for myself what they are doing here, I feel that Turkey is a hidden gem.

From the briefing of the JICA staff here, Turkey, being a country blessed with abundant food supply (its food imports are around only 6% of total imports) put it's effort into modernization and has a long history of engineering, which is part of the nation-wide strategy that started from the founding of the modern Turkey Republic.

This has resulted in many technical schools and universities and has put engineering as a preferred career path for many young Turks. Due to this, there is a strong culture and mindset of sound and strong engineering practices within the engineering community.

The tech sector here is more geared towards the international markets, which automatically makes them open to collaboration with foreign companies, and also able to understand the needs and requirements of different markets in the world.

The tech sector is definitely growing too: 10 years ago you might find less than 10 accelerators in Turkey, but now there are nearly 50 active ones, with around 1 to 10 new accelerators founded between now and then. This has also resulted in an increase of co-working spaces to accommodate all of the new companies.

Funding has also been steady: In 2019 they expect to get around USD 50 million of funding for startups in Turkey. The peak was in 2017, where they saw USD111.9 million funded.

For Japanese companies in the tech sector looking for offshore engineering resources, generally they will look to Vietnam or Myanmar (previously it was India) and most recently even to Ukraine to fulfill their engineering needs, but I think Turkey too is an attractive place to work with.

Summary of the JETRO program

If you're running a company in Japan, and if you're new to an industry or region, and looking to jumpstart there and start making connections or just to learn more, these mission programs by JETRO is a great way to do just that.

I also had the opportunity to meet and learn more from other Japanese delegates which were based outside of Japan. They bring in different perspectives, but and are valuable in the context of doing business in Japan but with a global view.

Because JETRO's mandate is to help Japanese businesses connect with business in other countries, the basic language used in documents will be in Japanese so having a business level Japanese language skills will definitely be helpful.

For Xoxzo, we hope to be able to leverage the connection and information we've managed to gain with these trips, and blend them to make our people and our products better.